Di Alberto Montero Soler

Professore di Economia applicata – Università di Malaga

Traduzione di Giuseppe Quaresima

Versione originale

I

Passano i mesi, diventano anni, e la possibilità che i paesi periferici dell’Eurozona superino questa crisi attraverso un percorso diverso da una soluzione di rottura si allontana sempre di più all’orizzonte.

Contro quanti insistono nel sostenere che esistano soluzioni riformiste capaci di affrontare l’attuale situazione di deterioramento economico e sociale, la realtà si sforza di dimostrare che la fattibilità di queste proposte richiede una condizione previa ineludibile: la modificazione radicale della struttura istituzionale, delle regole di funzionamento e della linea ideologica che guida il funzionamento dell’Eurozona.

Il problema di fondo è che questo contesto risulta funzionale ed essenziale al processo di accumulazione del gran capitale europeo; ma è anche funzionale, ed è qualcosa che dobbiamo avere sempre presente, al consolidamento del ruolo egemonico della Germania in Europa, e del ruolo al quale essa aspira nel nuovo ambito geopolitico multipolare in costruzione. Per questo motivo possiamo avanzare almeno due argomenti fondamentali per rafforzare la tesi della necessità della rottura del contesto restrittivo imposto dall’euro, se si desidera aprire il ventaglio di possibilità a percorsi di uscita da questa crisi che consentano una minima possibilità di emancipazione per l’insieme dei popoli europei.

Il primo argomento è che la soluzione alla crisi imposta da parte delle élite dominanti a livello europeo è, di per sé, una soluzione di rottura, attuata da queste in nome proprio e a proprio vantaggio. Le politiche di austerità costituiscono l’espressione più evidente del fatto che queste élite si trovano in una posizione di forza tale, rispetto al mondo del lavoro, da potersi permettere di rompere in maniera unilaterale e definitiva il patto implicito in base al quale si erano creati, rafforzati e mantenuti i welfare state europei. Queste élite sanno perfettamente che una classe lavoratrice precarizzata, de-ideologizzata, destrutturata e che ha perso ampiamente la sua coscienza di classe, è una classe lavoratrice indifesa, priva della capacità di resistenza necessaria per preservare le strutture di benessere che la proteggevano dall’inclemenza della mercantilizzazione dei bisogni economici e sociali essenziali. Le concessioni fatte durante il capitalismo fordista del dopoguerra sono a rischio di eliminazione perché, tra le altre cose, la privatizzazione del welfare state offre opportunità di guadagno tali da consentire il recupero della caduta del saggio di profitto.

Il secondo argomento è che non si può dimenticare, come invece sembra si faccia, la natura acquisita dal progetto di integrazione monetaria europea da quando venne posto in essere e da quando si cominciarono ad attuare le dinamiche economiche da esso promosse. Il problema essenziale è che l’eurozona è un ibrido che non evolve verso una federazione (con tutte le conseguenze che questo avrebbe in termini di cessione di sovranità), e si mantiene esclusivamente in un ambito di unificazione monetaria perché questa dimensione, insieme alla libertà di movimenti di capitali e di beni e servizi, è sufficiente per plasmare un mercato di grandi dimensioni che permetta un maggior livello di riproduzione del capitale, che elimini i rischi delle svalutazioni monetarie competitive da parte degli Stati, e che faciliti la dominazione di alcuni Stati su altri sulla base dell’apparente neutralità attribuita ai mercati.

Proprio per questo, l’Europa – e con essa la sua espressione di “integrazione” più avanzata che è l’euro – si è trasformata in un progetto esclusivamente economico, messo a servizio delle oligarchie industriali e finanziarie europee, con l’aggravante che in questo processo le oligarchie hanno cooptato la classe politica nazionale e sovranazionale, inibendo in questo modo i meccanismi di intervento politico in ambito economico, e restringendo i margini per qualsiasi tipo di riforma che non torni a vantaggio delle oligarchie stesse. Di conseguenza, questo spazio difficilmente può essere identificato e difeso da parte delle classi popolari europee come quella “Europa dei Cittadini” alla quale, una volta, la sinistra aveva aspirato.

II

Di fatto, esistono una serie di elementi che spiegano perché l’euro sia stato, nella prospettiva dei popoli europei, un progetto fallito fin dal principio: da un lato, tanto le politiche di aggiustamento strutturale attuate durante il processo di convergenza precedente all’introduzione dell’euro, quanto le politiche perseguite dalla sua entrata in vigore, hanno ridotto i tassi di crescita economica, con il conseguente impatto sulla creazione di posti di lavoro; dall’altro, l’assenza di una struttura fiscale di ridistribuzione del reddito e della ricchezza o di qualsiasi meccanismo di solidarietà che realmente risponda a questo principio ha reso difficile la riduzione dei disequilibri delle condizioni di benessere tra i cittadini degli Stati membri; infine, va evidenziato che le asimmetrie strutturali esistenti tra le diverse economie a partire dal periodo iniziale del progetto sono andate via via aumentando durante questi anni, rafforzando la struttura centro-periferia all’interno dell’Eurozona e consolidando la dimensione produttiva della crisi attuale.

Se a tutto questo aggiungiamo che le politiche messe in atto per salvare l’euro sono politiche dirette a preservare gli interessi dell’élite economica europea contro il benessere delle classi popolari, si riafferma l’idea di un rapido allontanamento dalla possibilità di identificare l’Eurozona con un processo di integrazione che i popoli europei possano riconoscere come proprio e costruito in base alle proprie aspirazioni.

Si può concludere, quindi, che l’euro – inteso non solo come una moneta in quanto tale, quanto come un complesso sistema istituzionale e una dinamica funzionale messa al servizio della riproduzione ampliata del capitale su scala europea – è la sintesi più cruda e perfetta del capitalismo neoliberista. Un capitalismo che si sviluppa nel contesto di un mercato unico dominato dall’imperativo categorico della competitività, e nel quale si è prodotto un vuoto delle sovranità nazionali – per non dire delle sovranità popolari – a tutto vantaggio di una tecnocrazia che agisce politicamente a favore delle élite europee, senza il benché minimo interesse alle condizioni di benessere delle classi popolari. E se siamo d’accordo sul fatto che per queste ultime la creazione dell’euro va intesa come un progetto fallito, la questione che sorge irrimediabilmente è che cosa le classi popolari possano fare – almeno quelle dei paesi periferici sopra le quali si sta esercitando con maggiore intensità il peso delle politiche di aggiustamento economico – di fronte ad un futuro che sembra così privo di speranza e nel quale le opzioni di riforma in senso solidale sono di fatto bloccate da catene sempre più strette.

La risposta a questa domanda dipende da quale concezione si ha della crisi attuale, delle dinamiche che la mantengono attiva, e delle prospettive di evoluzione delle relazioni politiche ed economiche all’interno dell’Eurozona che potrebbero invertire la situazione attuale, o, al contrario, consolidarla.

III

A mio avviso, la crisi presenta attualmente due dimensioni difficilmente riconciliabili e che favoriscono il consolidamento dello status quo presente.

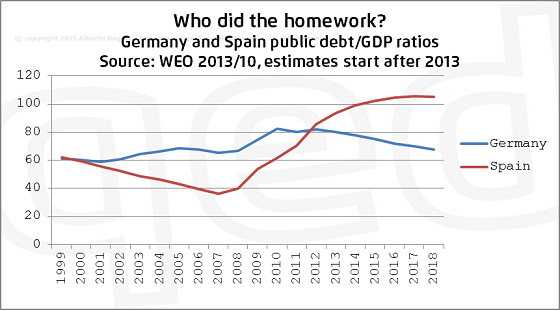

La prima dimensione è finanziaria e si incentra sul problema dell’indebitamento generalizzato che, nel caso della maggior parte dei paesi periferici, ha avuto inizio come problema di debito privato, convertitosi in debito pubblico quando è stato riscattato dallo Stato – e in questo modo socializzato – il debito del sistema finanziario. I livelli che ha raggiunto l’indebitamento, tanto privato come pubblico, sono così elevati che è impossibile che questo debito possa essere rimborsato completamente, e di questo bisogna essere assolutamente coscienti, date le conseguenze pratiche. Per questo, e per il fatto che, privati di moneta nazionale, alcuni Stati membri sperimentano tassi di crescita del debito molto superiori a quelli del Pil, il peso del debito si fa insostenibile e si trasforma in una bomba ad orologeria che prima o poi scoppierà senza possibilità di soluzione.

La seconda dimensione è reale e si concretizza nelle differenze di competitività tra le economie centrali e le economie periferiche. Queste differenze sono, con vari altri fattori, all’origine della crisi, e il problema di fondo è che non solo non si stanno riducendo, ma addirittura si stanno ampliando. Inoltre, l’interpretazione della riduzione degli squilibri esterni delle economie periferiche all’interno dell’Eurozona come un sintomo del fatto che siamo in una fase di transizione verso il superamento della crisi è chiaramente distorta, perché non considera in maniera adeguata la tremenda ripercussione del periodo di stagnazione economica sulle importazioni.

Il legame tra entrambe le dimensioni della crisi è assicurato dalla posizione dominante raggiunta dai paesi centrali rispetto a quelli periferici e, concretamente, dalla posizione raggiunta dalla Germania nello spazio dell’Eurozona, rilevante non solo per il suo peso economico, ma anche per il suo controllo politico delle dinamiche di riconfigurazione dell’Eurozona, sviluppate col pretesto di essere le soluzioni della crisi, ma che agiscono, di fatto, per rafforzare l’egemonia tedesca.

Se a questo aggiungiamo le peculiarità della sua struttura, caratterizzata dalla debolezza cronica della sua domanda interna – e, per questo, dall’esistenza ricorrente di un eccesso di risparmio nazionale – e la potenza della domanda estera dei suoi beni – che è alla base dei suoi continui surplus commerciali – avremo la prova del fatto che quello che sembrava essere un circolo virtuoso di crescita per tutta l’Eurozona ha finito per convertirsi in un giogo per le economie periferiche, sbocco privilegiato dei flussi finanziari attraverso i quali la Germania metteva a frutto l’eccesso di risparmio interno e il surplus commerciale, riciclandoli sotto forma di debito estero collocato nella periferia.

In questo modo, la Germania ha riconvertito la sua posizione creditoria in una posizione di dominazione quasi egemonica che le permette di imporre le politiche necessarie ai suoi interessi. Questo implica, in pratica, che qualsiasi soluzione di natura cooperativa per risolvere la crisi è automaticamente rifiutata mentre si rafforzano, al contrario, le soluzioni di natura competitiva tra economie le cui diseguaglianze in termini di competitività già si sono dimostrate insostenibili in un contesto così dissimile e asimmetrico come è quello dell’Eurozona.

E così è tanto tragico quanto sconsolante assistere all’accondiscendenza con la quale i governi dell’Eurozona periferica assumono e applicano politiche che stanno aggravando le differenze strutturali preesistenti e che, per questo, non fanno altro che accentuare le differenze in termini produttivi e di benessere tra il centro e la periferia, senza che possa essere intravista nessuna possibilità di soluzione: i processi di deflazione interna non solo comprimono il potere d’acquisto ma aumentano il peso reale del debito a livello interno, sia di quello privato (a causa della deflazione salariale), sia di quello pubblico (a causa del differenziale tra i tassi di crescita del Pil e del debito

pubblico), con l’aggravante che qualsiasi apprezzamento del tasso di cambio dell’euro si traduce in un’erosione dei benefici di competitività spuri conseguiti attraverso la deflazione salariale. Si tratta, proprio per questo, di un cammino verso l’abisso del sottosviluppo.

È proprio per questo che, se non si producono cambiamenti strutturali radicali (che passano tutti per meccanismi di trasferimento fiscale in chiave redistributiva), l’Eurozona si consoliderà come uno spazio asimmetrico di accumulazione di capitali, nel quale le economie periferiche si vedranno condannate a districarsi in una soluzione di equilibrio senza crescita – utilizzando un eufemismo economicistico – o, nel peggiore dei casi, l’Eurozona stessa finirà per saltare totalmente o parzialmente in aria.

Il problema è che queste riforme radicali non solo non sono all’ordine del giorno nell’agenda europea, ma sono anche sistematicamente bloccate dal veto della Germania. Di fatto, credo sia facilmente constatabile come in questi momenti, in seno all’Eurozona, esistano tensioni tra gli interessi delle élite economiche e finanziarie europee e quelli delle classi popolari dell’insieme dell’Eurozona, più marcate rispetto alle classi popolari degli Stati periferici; tra gli interessi della Germania e di altri Stati del centro e quelli degli Stati della periferia; e tra le proposte di soluzione della crisi imposta da dette élite e Stati e la logica economica più elementare, quella che resta espressa nelle principali identità macroeconomiche che riassumono le interrelazioni tra i saldi dei settori privato, pubblico e estero di un’economia. Tutte queste tensioni, debitamente gestite da coloro che detengono il potere nei differenti ambiti in cui esso si esprime, sono funzionali al consolidamento di un’Eurozona asimmetrica (con il significato già segnalato) e dominata dalla Germania.

IV

Queste tensioni, per concludere, riducono enormemente la possibilità di un’uscita dalla crisi, guidata dalle classi popolari, che non sia di rottura, così come è stato evidenziato all’inizio di questo testo. Il problema politico che si presenta appare evidente quando si consideri che gli unici che stanno immaginando questa possibilità di rottura unilaterale (di uscita dall’euro, per l’appunto) sono i partiti nazionalisti di estrema destra, che si appropriano così di un crescente sentimento di insoddisfazione popolare nei confronti dell’euro stesso, rispetto a una sinistra che continua ad invocare l’opzione di riforme che si scontrano direttamente con gli interessi di coloro che hanno posto a proprio servizio le potenzialità di dominio imperiale attraverso l’economia facilitate dall’euro. Da questo punto di vista, sarebbe opportuno smettere di visualizzare l’Euro semplicemente come una moneta, per arrivare ad assimilarlo concettualmente ad un’arma di distruzione di massa che sta distruggendo non solo il benessere dei popoli europei, ma anche quel sentimento europeista basato sulla fratellanza tra questi popoli che fu costruito con tanto sforzo.

Il problema di credibilità diventa ancora più grave per la sinistra quando, per promuovere le riforme necessarie, si appella all’attivazione di un soggetto, la “classe lavoratrice europea”, che agisca come avanguardia nella trasformazione della natura stessa dell’Eurozona. Il problema è che mai come ora la condizione della classe lavoratrice in Europa si è trovata così deteriorata quanto a coscienza e identità di classe, senza dover aggiungere che quanto detto non mina in nessun caso l’evidenza che la relazione salariale continua ad essere la pietra angolare del sistema capitalistico. Come scriveva recentemente Ulrich Beck, viviamo la tragedia di trovarci in momenti rivoluzionari senza rivoluzione e senza soggetto rivoluzionario. Non c’è nulla.

Ciò nonostante, l’orizzonte sarebbe più chiaro se la sinistra fosse capace di dare una risposta credibile ad una questione che si rifiuta di

considerare e che, tuttavia, può manifestarsi prima o poi nello scenario europeo e, concretamente, in Grecia: cosa potrebbe fare un governo di sinistra che raggiungesse il potere in un unico paese della periferia? Dovrebbe sperare che nel resto dell’Eurozona si manifestassero le condizioni obiettive per procedere alla sua riforma, essendo cosciente che questo esige il voto unanime dei 27 Stati? O dovrebbe approfittare del ventaglio di opportunità che la storia le ha permesso di aprire e promuovere l’uscita del proprio paese dall’euro?

Come è ovvio dare una risposta a tale domanda non è facile: tuttavia, eluderla non ha alcun senso. Per questo è necessario riconoscere – per iniziare – che nel contesto dell’euro non c’è nessun margine per politiche realmente trasformatrici che possano agire a vantaggio delle classi popolari. Anzi, oserei affermare che in questo contesto non c’è nessun margine per la politica, perché la politica è stata sequestrata dal sistema istituzionale sviluppato per fornire una patente di legittimità a una moneta dietro la quale manca qualsiasi progetto di costruzione di una comunità politica che integri i popoli d’Europa. Risulta, quindi, un controsenso reclamare processi costituenti, quando la condizione preliminare affinché processi simili possano realizzarsi pienamente è la rottura con il contesto istituzionale, politico, economico e legale imposto dell’euro. Una comunità può rifondarsi attraverso un processo costituente solo se lo fa senza vincoli preliminari nelle condizioni di partenza, vincoli imposti da fuori e che operano danneggiando gli interessi delle stesse classi popolari che reclamano questo processo costituente.

Per dirlo in altri termini, la rottura con l’euro non è condizione sufficiente ma necessaria per qualsiasi progetto di trasformazione sociale emancipatrice al quale la sinistra possa aspirare. Per questo, rivendicare la rivoluzione in astratto e, contemporaneamente, cercare di preservare la moneta unica e le istituzioni e le politiche che le sono consustanziali in questa Europa del Capitale, fino a quando si diano le condizioni europee per la loro riforma, costituisce una contraddizione in termini, priva di credibilità agli occhi di quelle classi popolari che sembrano aver identificato il nemico con maggiore chiarezza dei dirigenti della sinistra stessa.

È proprio per questo che fino a quando questa contraddizione non verrà compresa e superata, e i discorsi politici ed economici diventino entrambi di rottura e vadano in parallelo; fino a quando l’uscita dall’euro non sia percepita solo come un problema, ma anche come una parte della soluzione alla situazione di dipendenza delle economie periferiche, che offra loro la possibilità di ristrutturarsi e trovare il proprio percorso di sviluppo nella produzione e nell’elargizione di benessere in una forma più auto-centrata e meno dipendente dalle relazioni con l’economia mondiale; fino a quando non smetterà di incatenarci la paura di rompere le catene dell’euro, per la mancanza di certezze assolute su come potrebbe essere la nostra vita futura fuori dall’euro stesso (la stessa paura che ha incatenato coloro che negavano la possibilità di rompere con il gold standard dopo la grande depressione degli anni Trenta del secolo scorso); fino a quando tutto questo non accadrà, mi resta solo da pronosticare, ahimè, un lungo periodo di sofferenza sociale e economica per i popoli e i lavoratori della periferia europea.